Project Overview

College students have a tendency to have very poor financial management capabilities and they often struggle with high tuition plus student loans. They often don't have a long term plan to estimate their financial status. And there is a huge need for such tool to help them manage their money.

Project DUration

Research/ User Persona: Two Weeks

Wireframes/ Functions/ Activity Diagrams: Two Weeks

Final Output/ Mockup: One Week

Our Strategies

This app is not only aiming to monitor the past spending, earnings and forecast the future, but also to build up a healthy spending habit. We mainly focus on the discretionary spending because other spendings like rent, utilities, tuition are often fixed.

User Persona

Daniel Smith

Daniel is a junior at an art school, who is economically independent and loves socializing. He is getting closer to graduation. His financial situation concerns him and he would like to have more control over it. He currently has a loan check for $4000 every semester and earns $370 every two weeks. His total balance is $4880, but he owns $2700 on his credit card, which he is paying $50 per month.

Daniel’s Forecast based on past year spending and earning

Challenges and Solutions

Money is often hard to understand, especially in the long term and the effect of poor spending are rather unclear at the moment of purchasing. Therefore we are aiming to create a system that help to track each behavior and have a budget constraint that focuses on each week, month and year. Meanwhile we provide the opportunities to forecast the risk of unexpected spending.

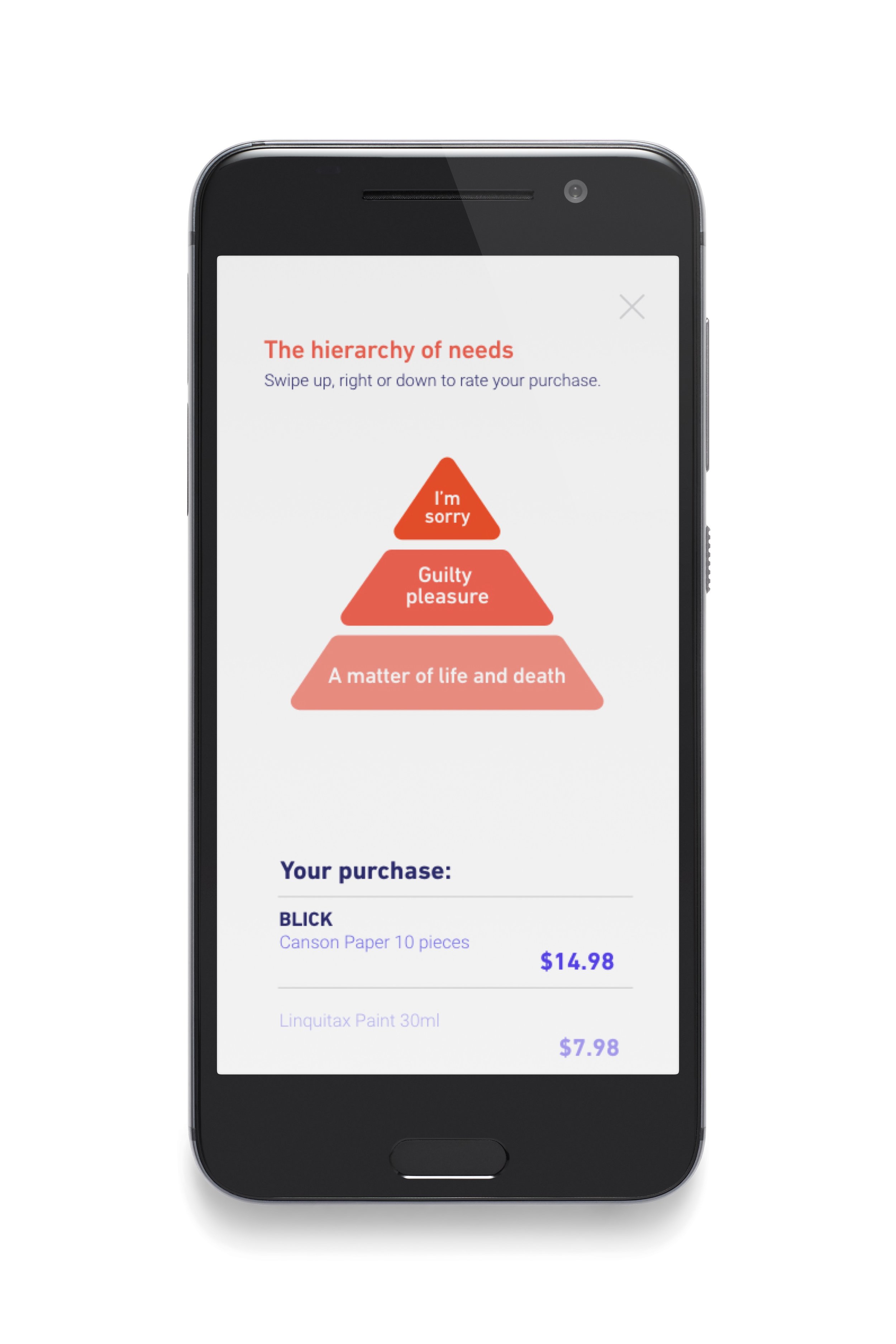

Hierarchy of needs

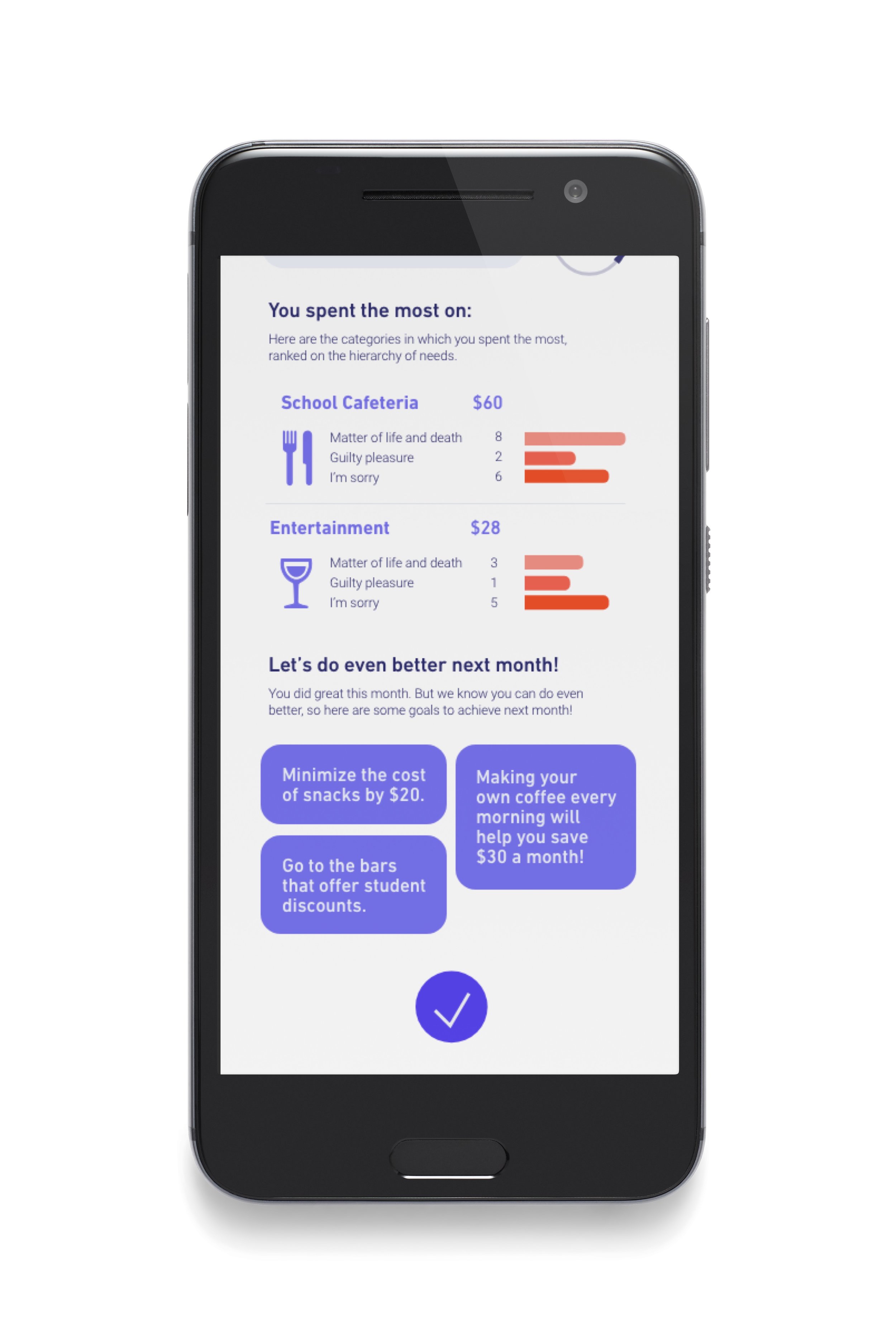

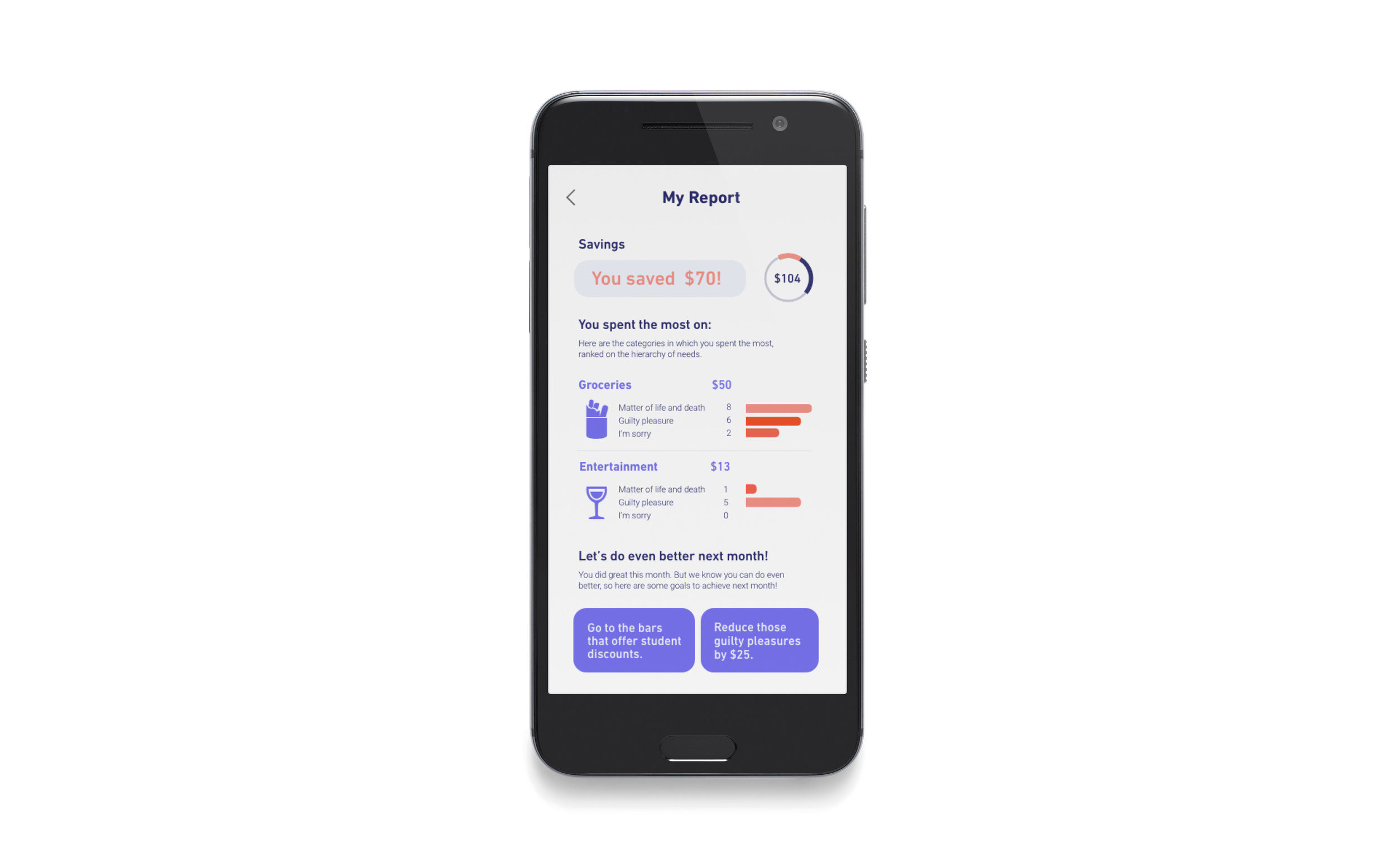

One of the distinct feature we have is to define all purchases into three major categories: I’m Sorry, Guilty Pleasure and A matter of life and death.

I’m sorry = Something you shouldn’t buy at all

Guilty pleasure = Something you can buy but you can save more from it

A matter of life and death = Something that are often necessities

We introduce a swiping mechanism to help build on this behavior as well as saving time when inputting data, by swiping up, right and down for different purchases. Over time, it would also build a psychological reaction to those behavior that would allow the user to get a better understanding of the decision they made.

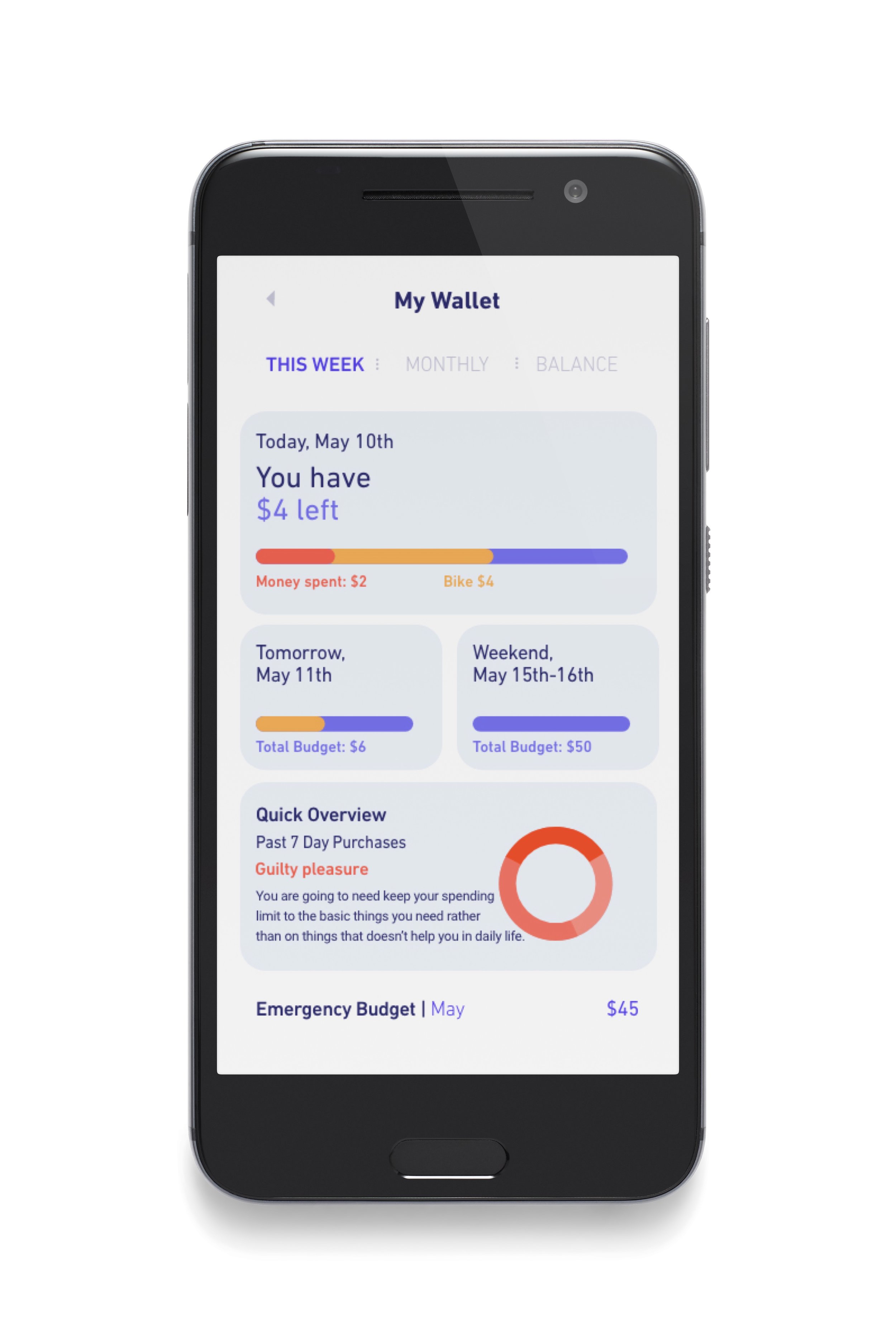

What If

There are often times we have something unexpected happens, thats just how life works. So we introduced a safety mechanism that would help cover those big purchases. What if your old bike were broken and you need a new one, or if the winter is coming and you really need a new coat. In cases like this, we would re-adjust the spending limit and giving advices and options to cover the cost by reducing some of the purchases of the next few months. That would safely let you get through the financial difficulties.

Structure diagram

Screens and functions

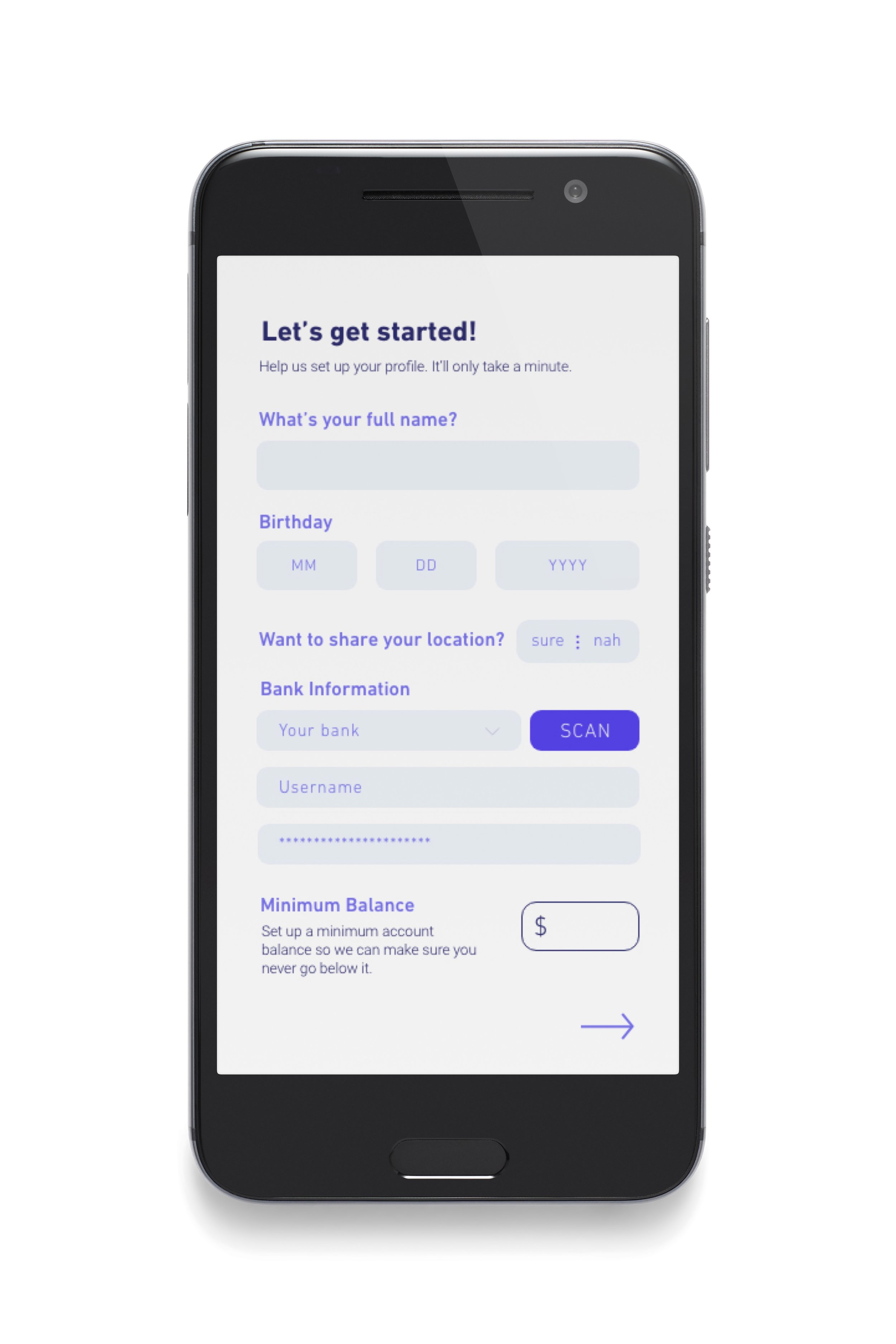

Initial Set Up - Profile Creation

Home Page

Hierarchy of Needs - Notification of Data Inputs

My Wallet - My Spendings

My Report - Quarterly Reports

What If - Large Purchases

Wokring prototype

Key Features

We help tracking the spending of the person by introducing the hierarchy of needs which gives definition for each purchase into luxury, pleasure and necessity. We help monitor spendings, and also giving the ability to handle unexpected large purchases by adjusting spending on daily items as well.

Finally, we would set up new goals after periodical reports and giving tips on what could the person do to save more in spending. The frequency of input is set by the user so he could manage it at his own pace.

This project is collaborated with Riesling Dong and Marina Porta.